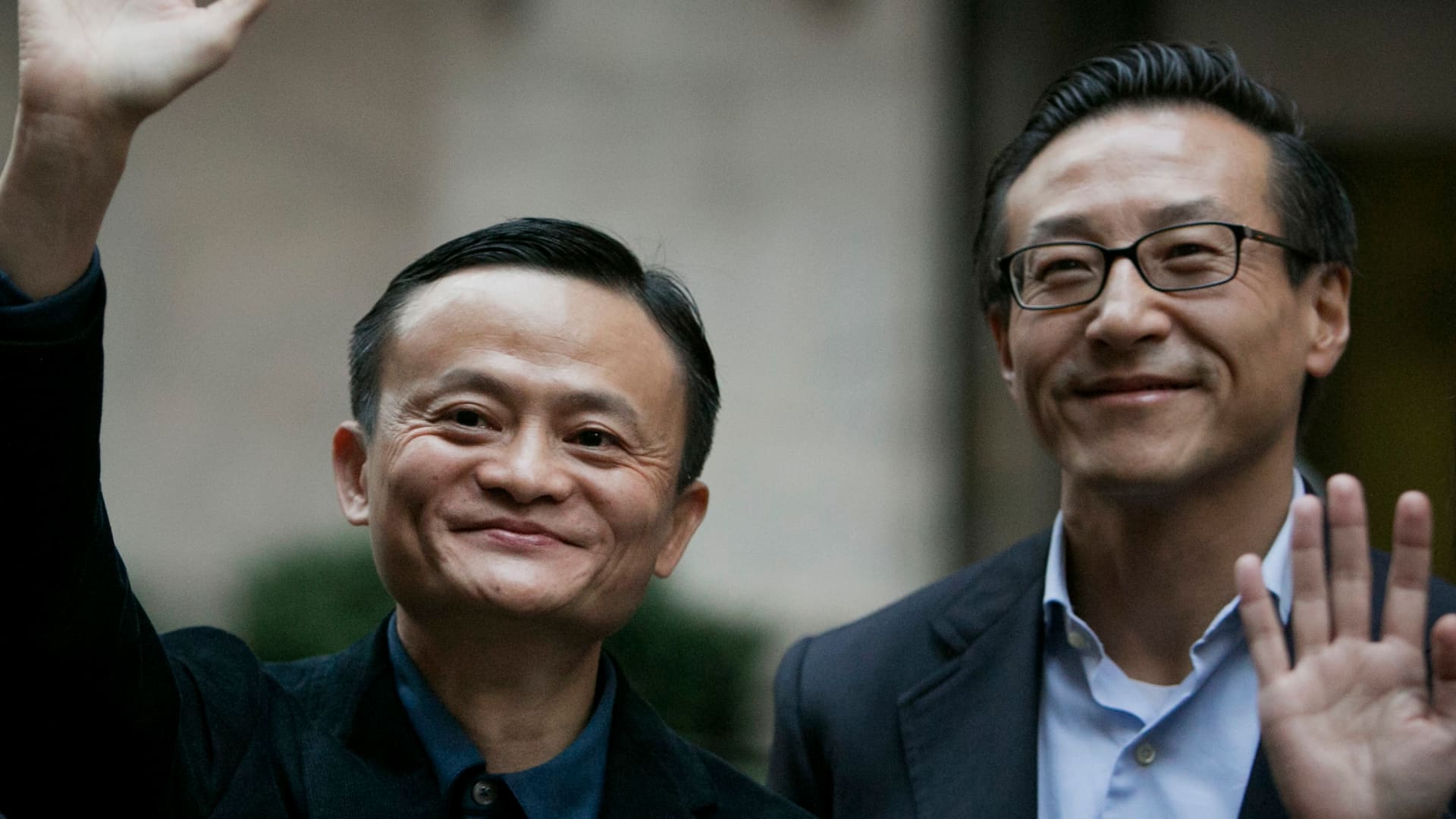

Alibaba co-founders Jack Ma and chairman Joe Tsai, in front of the New York Stock Exchange (NYSE) in New York, U.S., on Friday, Sept. 19, 2014.

Scott Eels | Bloomberg | Getty Images

Alibaba co-founders Jack Ma and Joe Tsai have acquired shares worth hundreds of millions of dollars on the open market, according to a regulatory filing and The New York Times, sending the company’s stock up around 7% in Tuesday morning trading.

An entity linked to Tsai’s family office, Blue Pool, acquired nearly 2 million Alibaba depository shares worth $152 million in the fourth quarter, according to a Tuesday regulatory filing. Separately, sources familiar with the matter told the Times that Ma acquired $50 million worth of Alibaba’s Hong Kong stock during the same period. Depository shares are effectively U.S.-traded versions of foreign stock.

Alibaba has a market cap of more than $174 billion.

Until recently, Ma had largely stepped out of the public eye. Tsai maintains a more visible profile as the owner of several sports teams, including the Brooklyn Nets.

But the company they founded in 1999 has suffered in recent years. A low point came in 2020 and 2021, when Ma publicly criticized Chinese officials and financial watchdogs, and regulatory pressure ultimately derailed a planned IPO for the Ant Group, Alibaba’s financial arm.

Geopolitical pressures have also weighed on the company. Alibaba announced in March 2023 that it would spin off its cloud business as part of a broader corporate reorganization. Months later, it scrapped those plans, citing U.S. semiconductor export controls. Around the same time the spinoff was canceled, Ma in a regulatory filing said that he would sell 10 million shares worth $870 million.

Alibaba shares are down roughly 21% since the cancelled spin-off.

Alibaba referred CNBC to Ma’s foundation, which did not immediately return a request for comment.