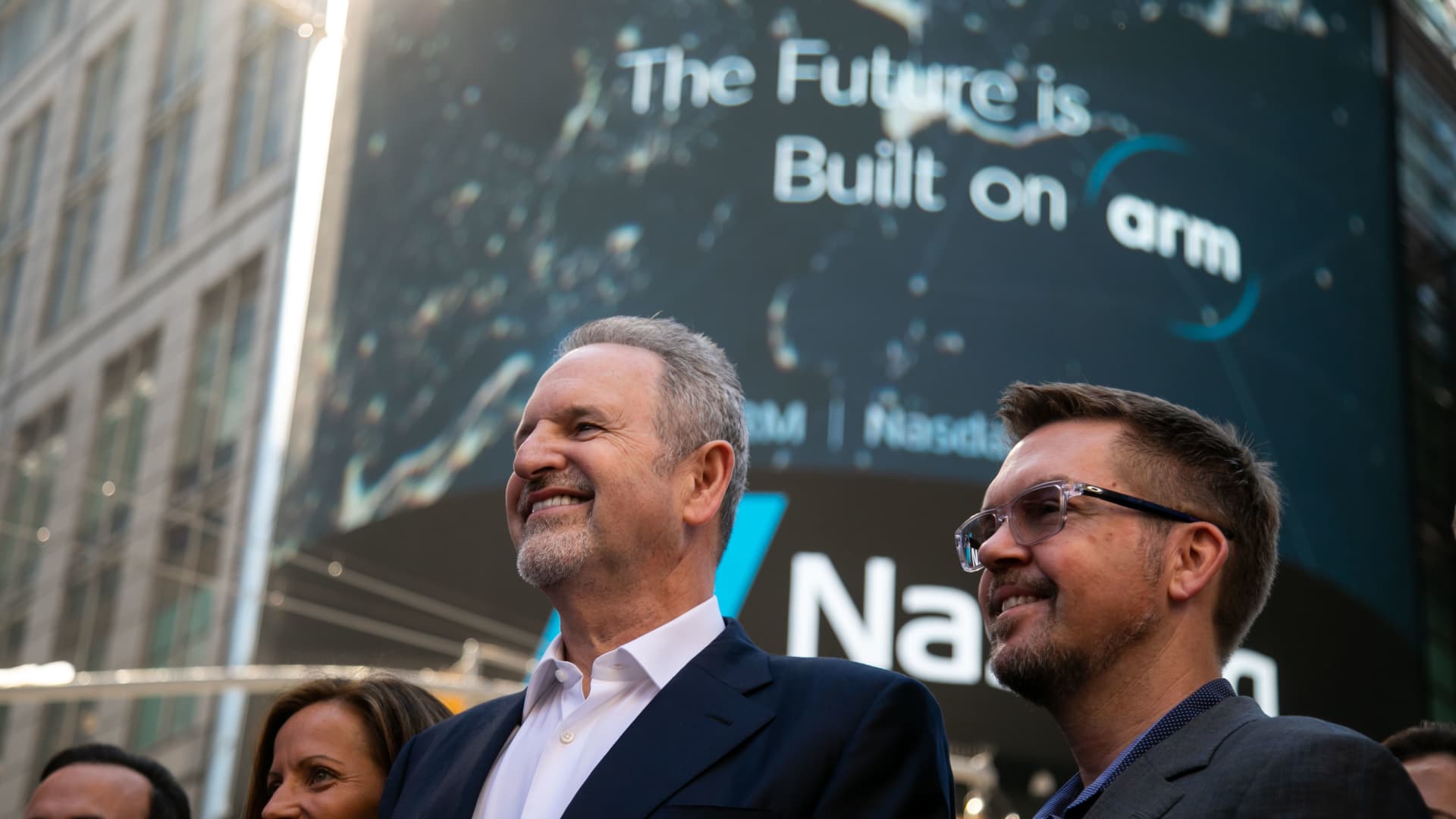

Rene Haas, chief government officer of Arm Ltd., heart, in the course of the firm’s IPO on the Nasdaq MarketSite in New York, US, on Thursday, Sept. 14, 2023.

Michael Nagle | Bloomberg | Getty Pictures

This report is from right now’s CNBC Every day Open, our new, worldwide markets e-newsletter. CNBC Every day Open brings traders in control on every thing they should know, irrespective of the place they’re. Like what you see? You may subscribe right here.

What it’s essential to know right now

The lengthy attain of Arm

Arm shares surged nearly 25% on its first day of buying and selling on New York’s Nasdaq, and an additional 6% in prolonged buying and selling. The chip designer priced its shares at $51 a chunk in its preliminary public providing. Shares of Arm started buying and selling at $56.10 a share and ended the day at $63.59. That provides the corporate a totally diluted market cap of about $68 billion, and a price-to-earnings a number of greater than Nvidia’s.

Markets rebound

U.S. shares rose Thursday, aided by Arm’s electrifying displaying and promising financial knowledge from the U.S. The Dow Jones Industrial Common, specifically, rallied 0.96% for its finest day since August. European markets traded greater, with the regional Stoxx 600 index climbing 1.52% and different main bourses including at the very least 1% following the European Central Financial institution’s charge resolution.

File charges within the EU

The ECB raised charges by 25 foundation factors to 4%, a document excessive reached after tenth consecutive hikes since June 2022 when charges had been -0.5%. The excellent news is that the ECB indicated it might be holding off additional hikes. “ECB rates of interest have reached ranges that … will make a considerable contribution to the well timed return of inflation to the goal,” the financial institution’s council stated.

Concentrate on the core

The U.S. producer worth index, which measures wholesale costs, rose a seasonally adjusted 0.7% in August — way over the 0.4% estimate — and 1.6% from a 12 months earlier. August was the most important month-to-month bounce in additional than a 12 months. Nonetheless, when stripping out meals and power costs, the month-over-month PPI was 0.2%, in keeping with expectations, and a couple of.1% on an annual foundation, the bottom since January 2021.

[PRO] No secret sauce for HP

Warren Buffett’s Berkshire Hathaway offered a portion of its stake in HP. This 12 months hasn’t been type to the pc and printer maker, as its fiscal third-quarter earnings missed Wall Road’s expectations. CNBC Professional’s Yun Li breaks down what Berkshire’s play in HP initially was, and whether or not it’s going to change going ahead — primarily based on one other wager the corporate has made prior to now.

The underside line

When you have got a toothache, your entire physique feels the ache. In the identical vein, when Arm skilled a flush of wellbeing, it radiated by markets’ whole physique, giving them their finest day in weeks.

“The profitable IPO of Arm … instills some confidence that maybe the capital markets window goes to open once more after just about being closed for the final 18 months,” stated Artwork Hogan, chief market strategist at B. Riley Monetary.

Massive banks rallied on pleasure that the sleepy IPO marketplace for tech corporations would possibly lastly be stirring. (Extra IPOs means extra dealmaking — and better income — for banks.) Shares of JPMorgan Chase rose nearly 2%, Morgan Stanley gained 2.09% and Goldman Sachs popped 2.86%. Tech IPOs are significantly necessary to Goldman because the financial institution depends on funding banking greater than its rivals. With Instacart and advertising agency Klaviyo set to checklist quickly, Goldman — which has been struggling of late — would possibly see a change in its fortunes.

Goldman and JPMorgan are large elements of the Dow. That helped the blue-chip index rise 0.96%, its finest day since Aug. 7, giving it a closing degree above its 50-day transferring common for the primary time since Sept. 1. The S&P 500 superior 0.84%, its finest displaying in round two weeks, and the Nasdaq Composite gained 0.81%.

In the meantime, a tame core PPI studying for August assuaged worries — considerably — after core client worth index was greater than anticipated. As PPI is taken into account a number one indicator, that’s, it predicts the long run state of the economic system, whereas CPI is a lagging indicator, markets discovered solace in the concept issues aren’t as unhealthy because the CPI appeared to painting.

And August retail gross sales jumped 0.6% in opposition to the 0.1% anticipated. Taken along with the PPI report, that means the U.S. economic system, supported by an indefatigable client, would possibly skirt a recession whilst inflation steadily cools.

“You have acquired the proper framework of inflation on course, however the economic system not falling aside,” Hogan stated. “And that basically paints the image that the Fed has completed the precise factor and we could be orchestrating that elusive delicate touchdown.”

However the economic system is infamously risky. Therefore Hogan’s all-important caveat: “No less than that is the impression we get this week.” Nonetheless, after markets ended within the pink final week, any reprieve, nonetheless short-term, will probably be welcome.