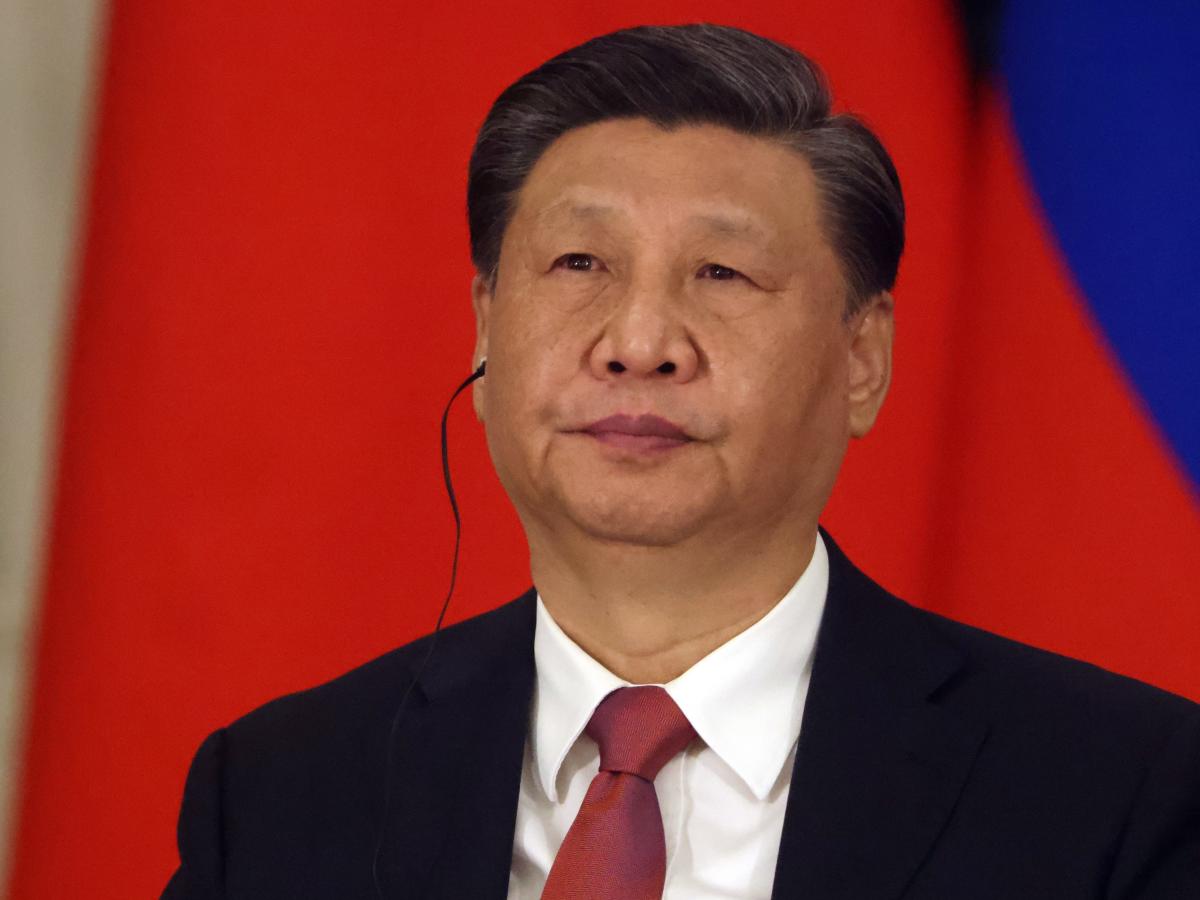

Chinese language President Xi Jinping.Getty Pictures

It is extremely unlikely that China will implement large-scale stimulus, Mohamed El-Erian stated.

With out it, markets should not anticipate China’s earlier fee of progress to come back again, he wrote within the Monetary Instances.

“Regardless of what many might proceed to inform you, it’s not a provided that China will turn into the world’s largest economic system.”

Bets that the Chinese language economic system nonetheless has a shot at reaching the highest might need to be reconsidered, Mohamed El-Erian wrote within the Monetary Instances.

Although blowout progress of previous a long time has helped China turn into the second-largest economic system on the earth, Beijing’s method in direction of the present droop has dampened views that it’s going to overtake the US.

“It’s time for the markets to acknowledge that China will not be reverting to its previous financial and monetary playbook, and its return as a robust driver of world financial progress is unlikely within the close to future,” El-Erian wrote. “Financial efficiency is more likely to stay lackluster for the rest of 2023 and the primary half of 2024.”

After China lifted pandemic restrictions late final 12 months, the economic system noticed a quick rebound early this 12 months. However since then, consumption, business exercise, funding, and exports have been disappointing, whereas youth employment hit document highs and costs have tipped into deflationary territory.

Although analysts and traders have loudly voiced hopes that China’s authorities implement a large-scale stimulus program to uplift its economic system and gas home spending, Beijing is unlikely to take action within the face of bigger structural points, El-Erian wrote.

That is as a result of earlier stimulus methods are liable for excessive debt ranges now seen in China’s native governments and teetering property market. Instead of this, the nation’s authorities have applied a collection of smaller-level measures.

Leaders are additional unlikely to pursue conventional stimulus, out of a fear that continued reliance on it could enhance the probabilities China would fall into the middle-income lure and likewise encourage corruption, El-Erian wrote.

Story continues

As a substitute, he predicted Beijing is more likely to proceed with smaller-level measures, whereas seeking to transition in direction of new progress industries, resembling inexperienced power, healthcare, supercomputing, and synthetic intelligence.

However challenges to progress will persist, and China must implement bigger debt restructuring measures. Added to that, Beijing might have to rethink its position in home markets, El-Erian stated:

“The authorities will even want to beat their now overwhelming inclination in direction of centralization and, as a substitute, allow however not micromanage the emergence of highly effective non-public sector engines of progress. Regardless of what many might proceed to inform you, it’s not a provided that China will turn into the world’s largest economic system.”

Equally, Bloomberg Economics stated on Tuesday that China is unlikely to completely take the highest spot, predicting gross home product would briefly surpass the US’s within the mid-2040s, however by “solely a small margin” earlier than “falling again behind.”

The economists — who beforehand noticed China overtaking the US within the 2030s — imagine GDP progress will gradual to simply 1% by 2050, revised down from an earlier prediction of 1.6%.

Learn the unique article on Enterprise Insider