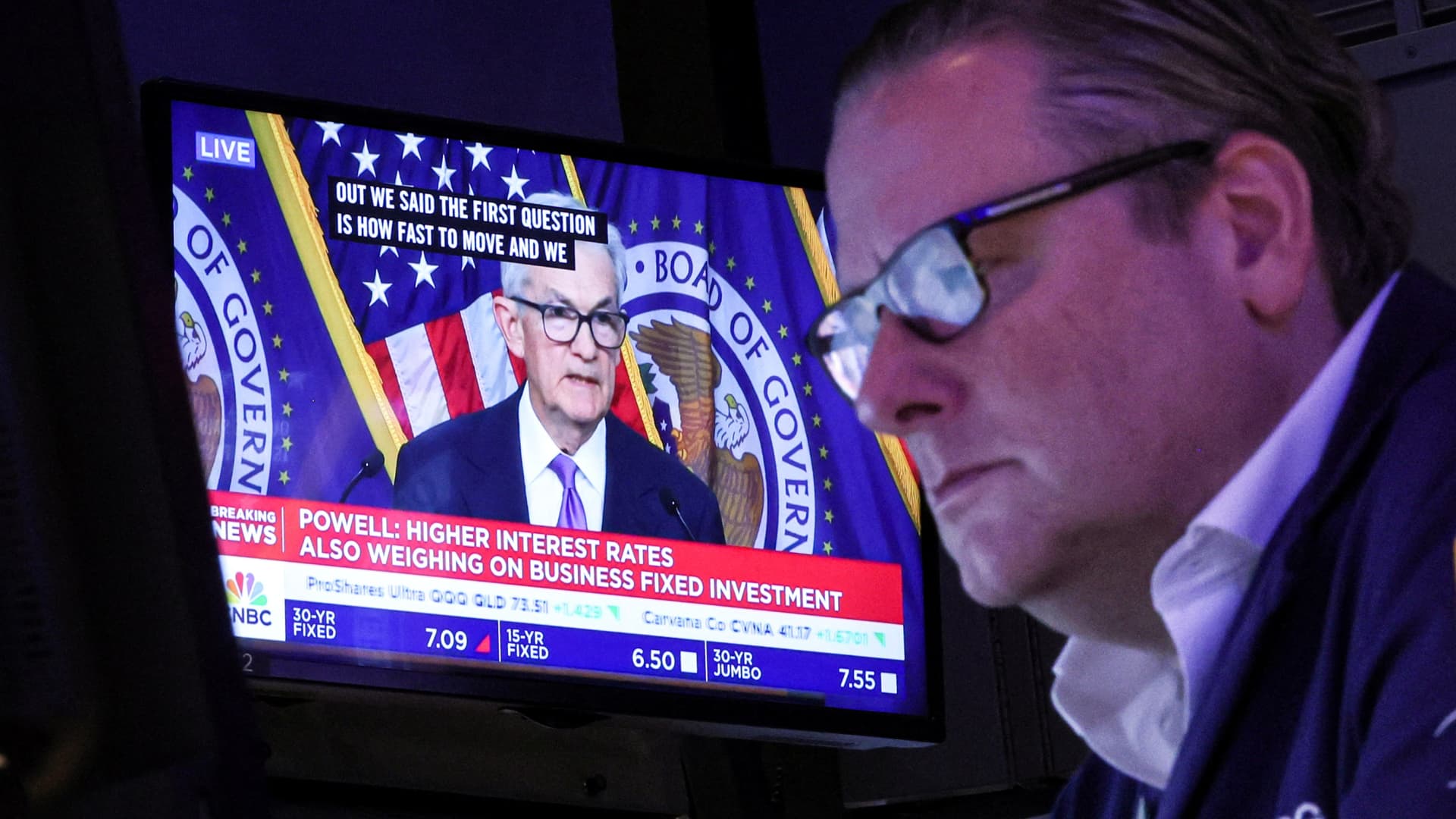

A trader works, as a screen displays a news conference by Federal Reserve Board Chairman Jerome Powell following the Fed rate announcement, on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., December 13, 2023.

Brendan Mcdermid | Reuters

This report is from today’s CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Asia markets fall

U.S. markets mostly rose Friday amid a tumultuous day of trading, giving major indexes their seventh consecutive week of gains. However, Asia-Pacific markets slumped Monday, with Hong Kong’s Hang Seng index falling around 1%. It was dragged down by shares of SenseTime, which plunged as much as 18.25% to its all-time low on news the company’s founder had passed away.

Cooling the heat

The U.S. Federal Reserve’s last meeting, during which it indicated three rate cuts for 2024, sparked “irrational exuberance,” said FDIC Chair Sheila Bair. It seems the Fed’s aware of that, and is trying to dampen market optimism. “We aren’t really talking about rate cuts right now,” New York Federal Reserve President John Williams told CNBC.

Lowered risk appetite

For the first half of the year, family offices in Asia had bet big on risky assets, said Hannes Hofmann of Citi Private Bank. That’s because Asian family offices were anticipating a rebound in China’s economy. But as the country’s economy slows down and Asian stock markets lag behind that of the U.S., that appetite for risk’s dwindling, according a Citi Private Bank global survey.

AI job losses

There are signs humans are losing jobs to artificial intelligence. According to a recent report from ResumeBuilder, 37% of respondents say AI has replaced workers this year, while 44% report AI will result in layoffs in 2024. But experts say this trend isn’t a wholesale replacement of humans — but a redefinition of the sort of jobs we can do.

[PRO] ‘Poised to pounce’

Jefferies is “poised to pounce” on several global stocks next year, the investment bank’s analysts wrote. Three stocks, which include companies with strong cash flows and attractive risk-reward ratios, made it to Jefferies’ top choices for 2024. And all of them have at least a 60% potential upside.

The bottom line

The “everything rally” spurred by Wednesday’s Federal Reserve meeting appears to have lost its legs — not least because the Fed itself seemed slightly spooked by how aggressively markets are pricing in rate cuts for next year.

According to the dot plot, which is a projection of where Fed officials expect interest rates to be in the future, there could be three 25-basis-point cuts next year. But markets think there’s more than a 38% chance rates will plummet to a range of 3.75% to 4% — that’s six 25-basis-point cuts — by December next year, according to the CME FedWatch Tool.

On Friday, New York Federal Reserve President John Williams tried to rein in some of that exuberance.

“I just think it’s just premature to be even thinking about that,” Williams said, when asked about futures pricing for a rate cut in March.

Williams even warned rates might go up.

“One thing we’ve learned even over the past year is that the data can move and in surprising ways, we need to be ready to move to tighten the policy further, if the progress of inflation were to stall or reverse.”

That could be one reason why markets were shaky Friday. The S&P 500 was essentially unchanged, the Dow Jones Industrial Average climbed 0.2% and the Nasdaq Composite added 0.4%.

That said, Friday also saw a quarterly event known as “triple witching,” the confluence of expiring stock index futures and options, as well as individual stock options. Furthermore, the S&P and Nasdaq-100 rebalanced their indexes, meaning the weight of some stocks on the index was changed. That could have exaggerated price moves and increased volatility as investors, accordingly, rebalanced their portfolios.

Finally, perhaps investors shouldn’t be surprised or disappointed the rally’s subsiding. “The market doesn’t go up every day, no matter how strong a trend is,” Chris Larkin, managing director of trading and investing at E-Trade points out. “Pullbacks and pauses are inevitable, regardless of how big they are or how long they last.”

The corollary to that is even a decline won’t last. Barring any shocks, signs are pointing to Santa spreading cheer in markets as the year wraps up.

— CNBC’s Yun Li contributed to this report.