The vacationer business is bouncing again after a tough couple of pandemic-stressed years, and within the case of some tourism and journey startups, its momentum is coming in at a tempo that’s defying the even the present market local weather.

At this time, GetYourGuide — a Berlin-based startup that has constructed a market for locating and reserving vacationer, journey and different experiences, with some 75,000 experiences from 16,000 suppliers listed at any given time — is asserting that it has raised $194 million.

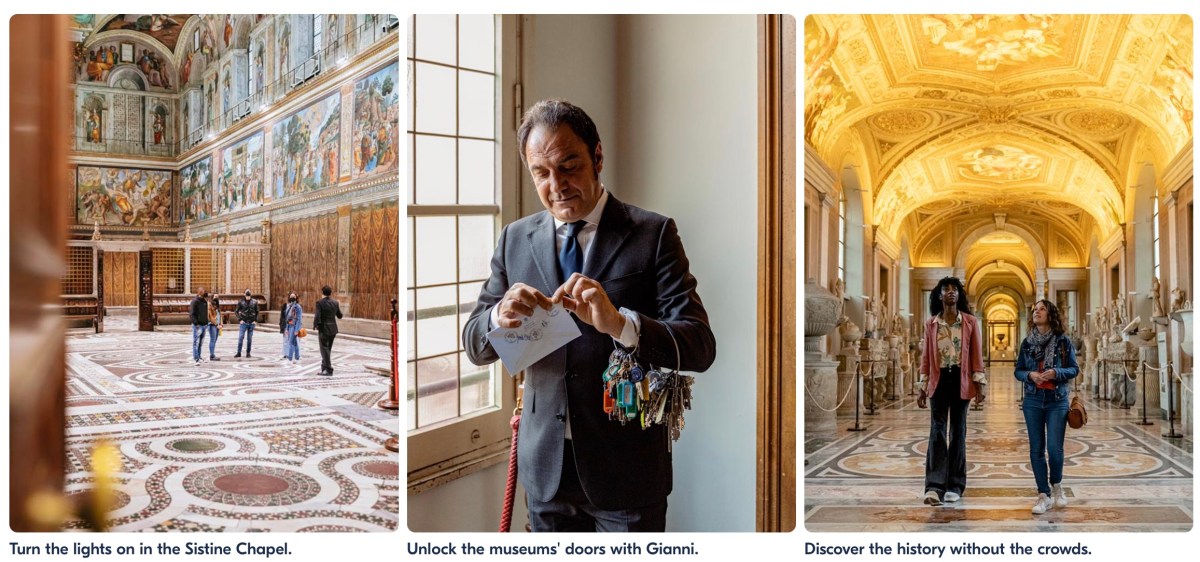

It is going to be utilizing the funds in three fundamental areas: first, to proceed increasing into new markets. Second, so as to add in additional hikes, excursions and different experiential occasions like assembly Gianni, the important thing holder for the entire of the Vatican, at 6am and turning on all of the lights as you stroll by means of the halls with him. And third, to herald extra AI and different know-how to enhance discovery and personalization on the platform.

The cash is coming within the type of an $85 million Collection F and a revolving credit score facility of $109 million. Blue Pool Capital led the fairness spherical with KKR and Temasek additionally taking part, whereas UniCredit led the credit score facility with participation from BNP Paribas, Citibank and KfW.

The spherical values GetYourGuide at $2 billion — double the startup’s valuation in comparison with its earlier spherical, a monster $484 million Collection E in 2019.

The funding, and valuation enhance, stand out within the present market as a result of consumer-oriented startups have been discovering it extraordinarily difficult to lift cash; and all startups, not simply shopper, are seeing a whole lot of strain on their valuations — two developments that GYG has simply bucked. (And it’s not the one journey startup making these waves: simply yesterday Hostaway introduced a $175 million increase.)

However the information additionally represents a fairly main turnaround for GetYourGuide itself.

Pre-Covid, Berlin’s GetYourGuide was one of many hottest startups in Europe, constructed on a quite simple concept: it took one of the crucial old school and outdated elements of tourism — guided excursions — and reinvented them as “experiences” to fulfill the wants, pursuits, and Instagrammable necessities of a brand new wave of youthful customers, all discoverable and bookable utilizing everybody’s favourite system, the smartphone.

The concept took off like a rocket — a efficiently launched one. Bookings went up, traders flocked to the startup, it moved into a really spectacular digs within the east of Berlin, and folks began to assume that possibly it wasn’t simply Airbnb that might inside a decade upend how we take into consideration journey.

Then Covid-19 occurred.

“We went from high-flying to zero revenues — zero revenues for a number of quarters,” CEO and co-founder Johannes Reck recalled. “Plenty of startups struggled at the moment, however we had been one of many worst hit. In fact, nobody wished to go on excursions with different folks” — which was successfully the one product that GYG provided. “It was actually unhealthy.”

Reck took a daring guess at the moment: he determined that shopper habits, the curiosity in experiences that had been driving enterprise for the startup, wouldn’t change; it will possible simply pause beneath pandemic circumstances.

“I used to be at all times satisfied that we’d return and that our market would come out higher than it was even pre-pandemic. First it’s as a result of folks crave experiences. Covid was a giant setback however not a fork within the street the place shopper habits can be totally different,” he mentioned. “Second, I used to be very certain journey would return, and vacationers wouldn’t wish to sit in lodge rooms for the following century.”

The corporate’s $484 million spherical led by SoftBank closed simply months earlier than Covid-19 hit, so GYG had loads of money. However on high of that it secured a $133 million convertible notice, in case issues bought actually furry. It additionally laid off 20% of its employees, all advised, however then it held tight. “We didn’t reduce deep,” Reck mentioned. “We stopped and waited for 8-10 months to cross.”

It took a bit longer — round two years in reality — however ultimately issues began to select again up. GYG by no means did train the convertible notice, Reck mentioned.

The tip of 2022, with the Omicron wave of Covid-19 subsiding, was the turning level, he recalled, with all the things “simply beginning to fall again in place.” By Q1 of 2023, the startup was seeing reserving volumes that had been 4 instances greater than its volumes in Q1 in 2019 (the final comparable yr of non-Covid normalcy). It’s not talking particular numbers on volumes however it had about 25-30 million tickets bought on its app between 2019 and 2020; 4 instances that may be 100-120 million.

Reck added that now it’s wanting like the corporate is “on the path to profitability” in lots of its main markets.

In fact, that route, in contrast to a GYG tour, doesn’t have a well-defined beginning or finish level, nor estimated time of arrival. Nevertheless it appears to be one which traders are glad to ebook and comply with regardless.

“There’s immense alternative within the digitization of the experiences business, and we imagine GetYourGuide’s world management and market-leading customer-centricity within the class stems from its deep experience on this advanced house,” mentioned Oliver Weisberg, CEO of Blue Pool Capital, in an announcement. “We imagine GetYourGuide is uniquely positioned to be the worldwide chief within the class; we’re happy to guide the fairness financing given the power of the enterprise.”

In the meantime, the long run for GYG has a few attention-grabbing know-how and enterprise variables at play.

Reck mentioned that GYG stays very dedicated to the concept of promoting human-led group excursions. Meaning: no self-guided excursions, no digital excursions, and no generative-AI created excursions are on its roadmap at present.

Reck calls the group tour, devised and led by an precise particular person, “the core product” of GYG. “Our mission simply doesn’t occur if you’re glued to your smartphone,” he mentioned. He speaks not simply from opinion however expertise: “We’ve examined so many various codecs, together with digital experiences,” Reck mentioned. “All of them flopped.”

However that’s to not say that there aren’t some huge alternatives for utilizing AI within the enterprise. Reck mentioned.

A few week in the past, the corporate launched a ChatGPT integration that lets customers provoke a search of GYG’s catalogue by means of natural-language queries. That solves a giant ache level for the corporate, which has been that fundamental key phrase searches will not be adequate to provide helpful search outcomes.

Over time, there is also additional extensions of this the place GYG can begin to get extra correct concepts of what folks love to do and have a look at to provide them much more correct search outcomes; and GYG aggregates the info to get a greater image of what its buyer base desires kind of of — analytics and information that it may in flip feed again to its suppliers to construct higher future excursions.

“I don’t see AI as an finish in itself however a device to assist suppliers and customers,” he mentioned. “There are such a lot of several types of experiences, and AI will assist determine what’s for you.”