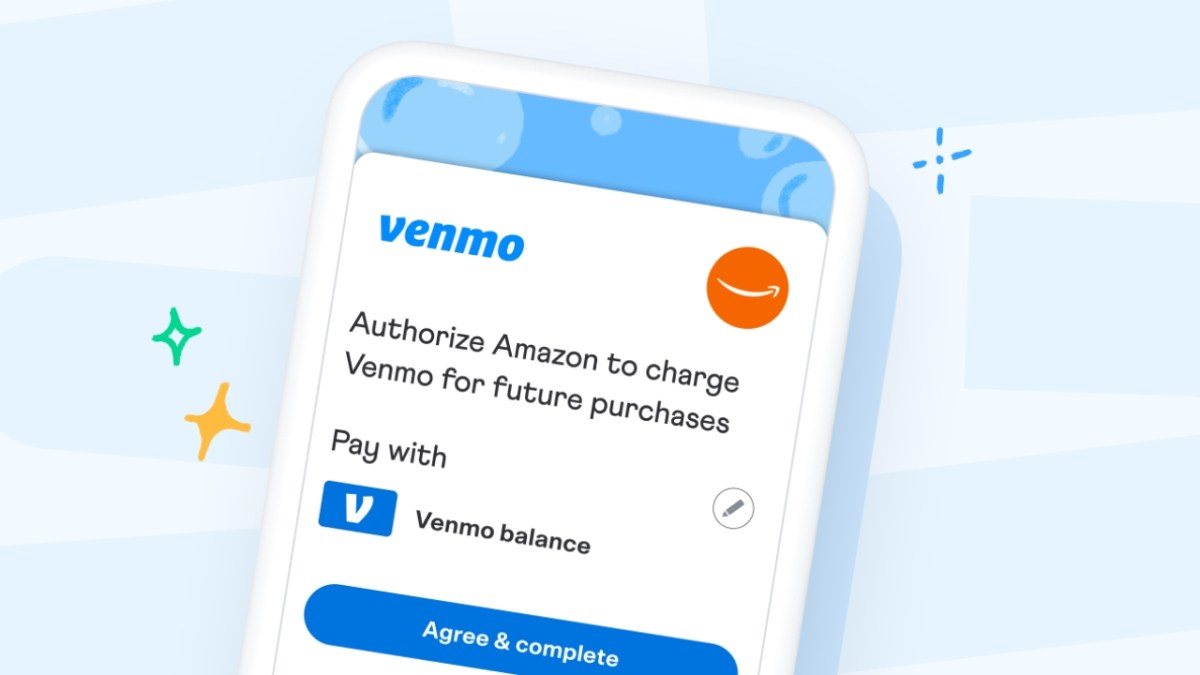

1099-K IRS Tax Delay: What Last Minute Filers Who Use PayPal and Venmo Need to Know

If you haven’t filed your taxes yet this year, you have until midnight on April 15 to submit your tax return. If you received any freelance income this year through PayPal, Venmo, Cash App or Zelle, you might be confused about what the 1099-K changes mean for your current tax return. This story is part … Read more