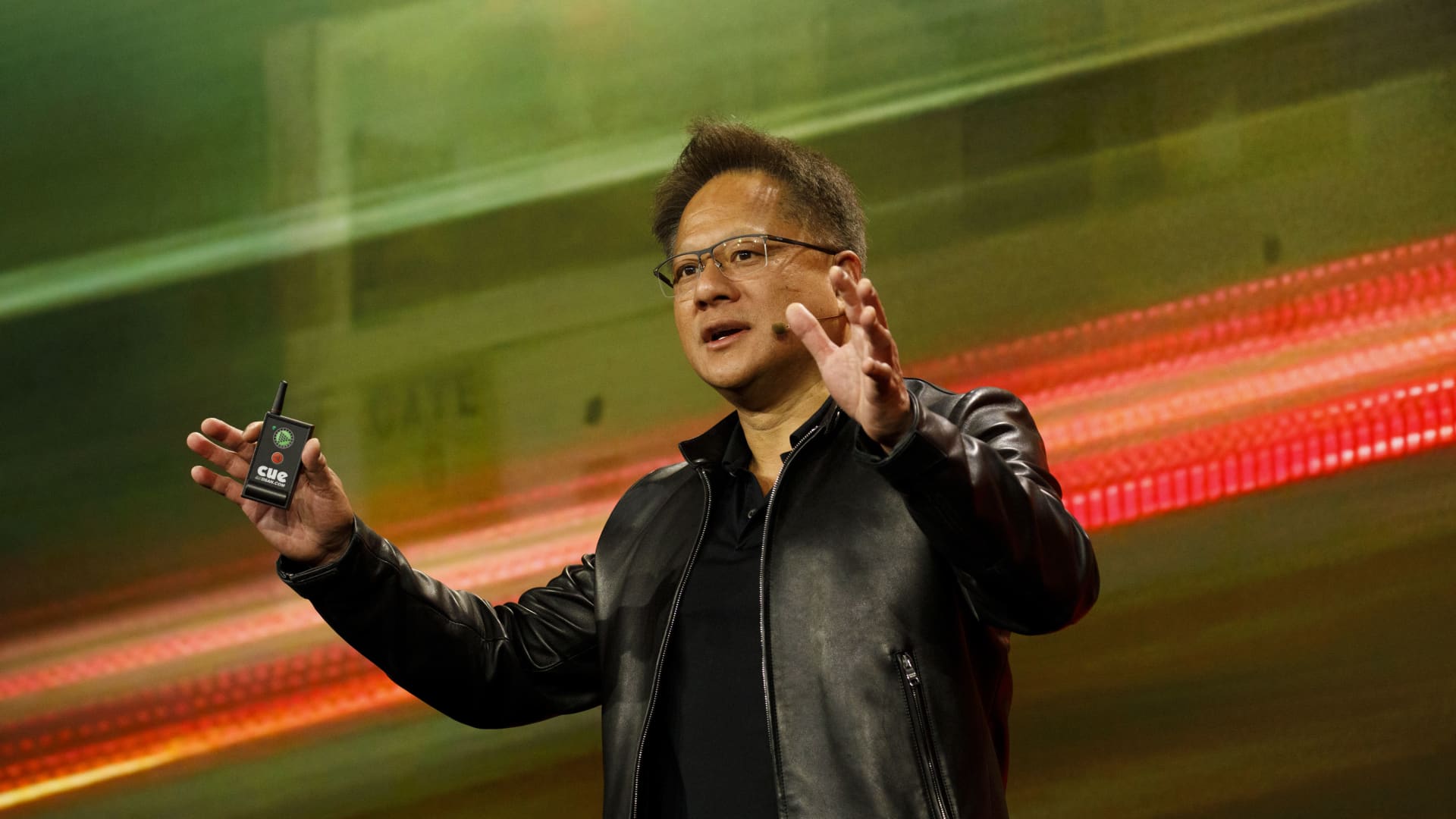

Jen-Hsun Huang, president and chief govt officer of Nvidia Corp., speaks through the firm’s occasion at Cellular World Congress Americas in Los Angeles, California, U.S., on Monday, Oct. 21, 2019.

Patrick T. Fallon | Bloomberg | Getty Photos

Neglect concerning the debt ceiling. Tech buyers are in purchase mode.

The Nasdaq Composite closed out its fifth-straight weekly achieve on Friday, leaping 2.5% previously 5 days, and is now up 24% this 12 months, far outpacing the opposite main U.S. indexes. The S&P 500 is up 9.5% for the 12 months and the Dow Jones Industrial Common is down barely.

Pleasure surrounding chipmaker Nvidia’s blowout earnings report and its management place in synthetic intelligence know-how drove this week’s rally, however buyers additionally snapped up shares of Microsoft, Meta and Alphabet, every of which have their very own AI story to inform.

And with optimism brewing that lawmakers are near a deal to boost the debt ceiling, and that the Federal Reserve could also be slowing its tempo of rate of interest hikes, this 12 months’s inventory market is beginning to look much less like 2022 and extra just like the tech-happy decade that preceded it.

“Being concentrated in these mega-cap tech shares has been the place to be on this market,” stated Victoria Greene, chief funding officer of G Squared Non-public Wealth, in an interview on CNBC’s “Worldwide Alternate” Friday morning. “You can’t deny the potential in AI, you can’t deny the earnings prowess that these firms have.”

To start out the 12 months, the primary theme in tech was layoffs and price cuts. Lots of the greatest firms within the business, together with Meta, Alphabet, Amazon and Microsoft, have been eliminating 1000’s of jobs following a dismal 2022 for income progress and inventory costs. In earnings reviews, they emphasised effectivity and their means to “do extra with much less,” a theme that resonates with the Wall Road crowd.

However buyers have shifted their focus to AI now that firms are showcasing real-world purposes of the long-hyped know-how. OpenAI has exploded after releasing the chatbot ChatGPT final 12 months, and its greatest investor, Microsoft, is embedding the core know-how in as many merchandise as it may possibly.

Google, in the meantime, is touting its rival AI mannequin at each alternative, and Meta CEO Mark Zuckerberg would a lot moderately inform shareholders about his firm’s AI developments than the corporate’s money-bleeding metaverse efforts.

Enter Nvidia.

The chipmaker, recognized finest for its graphics processing models (GPUs) that energy superior video video games, is using the AI wave. The inventory soared 25% this week to a file and lifted the corporate’s market cap to almost $1 trillion after first-quarter earnings topped estimates.

Nvidia shares at the moment are up 167% this 12 months, topping all firms within the S&P 500. The subsequent three prime gainers within the index are additionally tech firms: Meta, Superior Micro Units and Salesforce.

Zoom In IconArrows pointing outwards

The story for Nvidia relies on what’s coming, as its income within the newest quarter fell 13% from a 12 months earlier due to a 38% drop within the gaming division. However the firm’s gross sales forecast for the present quarter was roughly 50% larger than Wall Road estimates, and CEO Jensen Huang stated Nvidia is seeing “surging demand” for its knowledge heart merchandise.

Nvidia stated cloud distributors and web firms are shopping for up GPU chips and utilizing the processors to coach and deploy generative AI purposes like ChatGPT.

“At this level within the cycle, I feel it is actually essential to not battle consensus,” stated Brent Bracelin, an analyst at Piper Sandler who covers cloud and software program firms, in a Friday interview on CNBC’s “Squawk on the Road.”

“The consensus is, on AI, the massive get greater,” Bracelin stated. “And I feel that is going to proceed to be one of the simplest ways to play the AI tendencies.”

Microsoft, which Bracelin recommends shopping for, rose 4.6% this week and is now up 39% for the 12 months. Meta gained 6.7% for the week and has greater than doubled in 2023 after dropping nearly two-thirds of its worth final 12 months. Alphabet rose 1.5% this week, bringing its improve for the 12 months to 41%.

One of many greatest drags on tech shares final 12 months was the central financial institution’s constant rate of interest hikes. The will increase have continued into 2023, with the fed funds goal vary climbing to five%-5.25% in early Might. However on the final Fed assembly, some members indicated that they anticipated a slowdown in financial progress to take away the necessity for additional tightening, in line with minutes launched on Wednesday.

Much less aggressive financial coverage is seen as a bullish signal for tech and different riskier property, which usually outperform in a extra steady price surroundings.

Nonetheless, some buyers are involved that the tech rally has gone too far given the vulnerabilities that stay within the economic system and in authorities. The divided Congress is making a debt ceiling deal troublesome because the Treasury Division’s June 1 deadline approaches. Republican negotiator Rep. Garret Graves of Louisiana instructed reporters Friday afternoon within the Capitol that, “We proceed to have main points that we’ve not bridged the hole on.”

Treasury Secretary Janet Yellen stated in a while Friday that the U.S. will possible have sufficient reserves to push off a possible debt default till June 5.

Alli McCartney, managing director at UBS Non-public Wealth Administration, instructed CNBC’s “Squawk on the Road” on Friday that following the current rebound in tech shares, “it is most likely time to take a few of that off the desk.” She stated her group has spent plenty of time trying on the enterprise market and the place offers are taking place, and so they’ve seen some clear froth.

“You are both AI otherwise you’re not proper now,” McCartney stated. “We actually should be able to see if we do not get an ideal debt ceiling, if we do not get an ideal touchdown, what does that imply, as a result of at these sorts of ranges we’re positively pricing within the U.S. hitting the excessive be aware on the whole lot and that looks like a really precarious place to be given the dangers on the market.”

WATCH: CNBC’s full interview with UBS’ Alli McCartney